Year after year, exorbitant interest fees and onerous, unrealistic balloon payments are draining money from the meager earnings of Indiana's most financially vulnerable citizens. Even small financial emergencies regularly take working people and military families down the path to bankruptcy because they must turn to payday predatory lenders, whose schemes trap borrowers in a never-ending cycle of debt.

Year after year, exorbitant interest fees and onerous, unrealistic balloon payments are draining money from the meager earnings of Indiana's most financially vulnerable citizens. Even small financial emergencies regularly take working people and military families down the path to bankruptcy because they must turn to payday predatory lenders, whose schemes trap borrowers in a never-ending cycle of debt.

Predatory lending abuses continue to be codified in Indiana. In 2020 SEA 395 was passed, allowing excessive fees by lenders that distort the interest rate. The result is that non-bank lenders can now charge an APR of 89 percent for a $500 six-month loan. Struggling families have once again been ignored by legislators who should adopt an equitable 36 percent interest cap that includes fees.

For those who want to join the fight poverty, there is an answer and any Indiana employer can help. Community Loan Centers of Indiana (CLC) fund loans, backed by banks through any employer in the state. The process is pretty simple for both the employer and the employee and the bank takes the financial risk. Employers merely deduct the repayment amount from the borrower's paycheck. PERIOD.

These loans are literally life savers. Forty one percent of borrowers report increased savings, 66 percent reduced their debts, and 44 percent improved their credit score. This is the exact opposite of what happens to borrowers involved with payday predatory loan schemes.

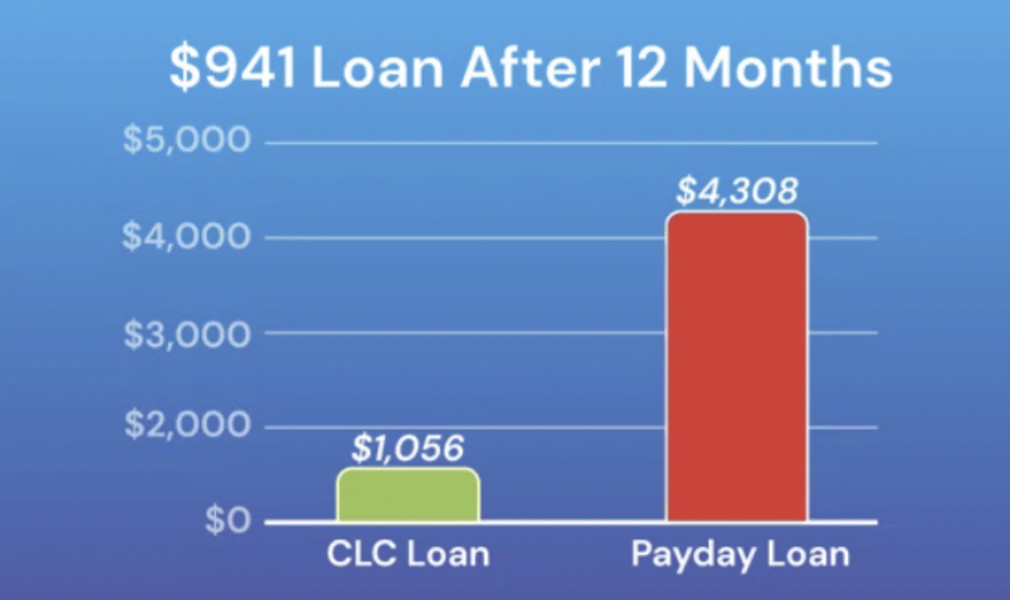

CIC loans up to $1,000 or up to half of a borrower's monthly gross pay for a one year term. There is a $20 origination fee and the loan is paid back at 18 percent. There's no credit check, no collateral, no prepayment penalties, and repayments run from $23 per week to $94 per month, and anyone who works with an employer who offers this service can borrow after three months of employment. Just check out the graph above and compare costs of a CLC loan to the costs of a payday loan. Huge difference.

We need more banks to step up and claim the open areas of Indiana—which include Central Indiana, but any employer in the state can become a lender now as existing banks are well-equipped and ready to serve anywhere in the state. It's a win/win for employers and employees alike and over time it can cut the legs off predatory lenders.

The portal is online at CLCofIndiana.org complete with financial education services. Check out the video to learn more Here. And if you just want to ask some questions, contact Teresa Reimschisel at Prosperity Indiana. She is committed to CLC success, as is UNITE INDY as we remain committed to attacking the root causes of poverty.

Next: Let's get a legislature that will pass a 36 percent APR cap that includes all fees,

Nancy